Keys to success:

1. Know your audience or target market.

Your audience is a specific group of consumers who are likely to use (and can benefit from) your services, and effective marketing requires intimate knowledge of this group. It’s important to understand their demographics (gender, age, income, education, occupation, and location) and psychographics (habits, hobbies, lifestyle, and beliefs).

Also, discover where your audience spends their time, including social media platforms and websites visited. Only when you can identify and speak directly to your audience can you provide the right solution.

2. Cultivate your brand.

A brand is more than a name, logo, or colors — it’s at the core of your credit union’s character. Ideally, it should reflect your credit union’s mission, vision, and values. It includes integrated marketing but also your approach to member service, hiring, and serving the community. By giving life to your brand, you’re giving your credit union a relatable personality and an edge over your competitors. Your brand is also part of your web content and newsletters, social media posts, and emails.

3. Adopt multi-channel marketing.

The way members hear your messages has changed forever, requiring a multi-channel marketing approach. Channels include traditional print, newsletters, direct mail, and ever-evolving social media channels, websites, and other digital media marketing. The key is to understand your data and the channels trending in your market — and crafting the appropriate message within each channel.

Consider these two scenarios:

Prompted by a traditional mailer, my mother-in-law — who doesn’t have access to email, social media, or even the internet — bought her latest car at age 70. Her purchase was made in a very conventional manner. Meanwhile, my daughter, age 25, bought her first car via an Instagram post. The point is that credit unions need to adopt a multi-channel marketing approach: direct mail, social media, a web banner or mobile ad, email blast, newsletter, or YouTube video. There’s no single channel that will fit all members, all of the time.

Prompted by a traditional mailer, my mother-in-law — who doesn’t have access to email, social media, or even the internet — bought her latest car at age 70. Her purchase was made in a very conventional manner. Meanwhile, my daughter, age 25, bought her first car via an Instagram post. The point is that credit unions need to adopt a multi-channel marketing approach: direct mail, social media, a web banner or mobile ad, email blast, newsletter, or YouTube video. There’s no single channel that will fit all members, all of the time.

— Holly Mackewicz, Colorworks

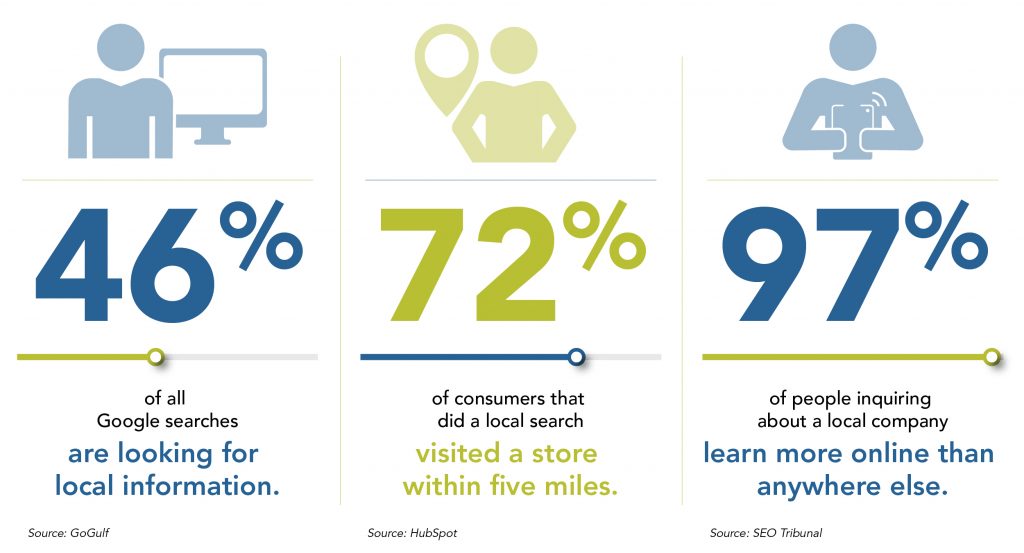

4. Find your local niche.

The not-for-profit philosophy of credit unions is the perfect business model for local marketing — targeting current or potential members that live or work within a certain distance of your location, based on city or zip code. It’s also an often overlooked marketing method, notes Business.com, as many small businesses follow the marketing cues from larger conglomerates.

Local marketing can also enhance community partnerships or business opportunities and foster goodwill. Consider the benefits of local media, such as local newspapers, weekly flyers, or local radio stations. Another way to drive local traffic is to list on Yelp, White pages, Angie’s List, and other local directories.

5. Leverage member testimonials.

Members who are willing to share their credit union stories are marketing gold. Not only do testimonials provide an intimate view of how you helped the member solve a problem or reach a goal, but they leverage relatable examples for your audience.

Stories like a member buying their first car or home, launching a business, or sending a child to college resonate with just about everyone. Feature these stories on your website, in newsletters, video marketing, or emails.

6. Embrace social media.

With more than 2.8 billion Facebook users and 1 billion on Instagram, there’s no need for us to tell you about the popularity of social media. But make no mistake; social campaigns can be a uniquely strategic tool for credit unions and their member-owned philosophy. Use photos, videos, and testimonials to assimilate the member experience within your social channels. Reinforce marketing campaigns and use them to address questions or concerns.

7. Think mobile-first.

Statistics underscore the absolute necessity of integrating a mobile-first philosophy into your local marketing and approach to business.

Consider this from HubSpot:

Members are also spending significant chunks of time on their phones. According to Evolve-systems.com, “Americans spent an average of 4 hours on their phones every day in 2020, and 80% of smartphone users will buy from companies with mobile sites and apps that are easy to navigate.”

Don’t miss this opportunity. If you haven’t yet mobile-optimized your website, consider it a goal for 2022. It will assist with mobile functionality and SEO (search engine optimization) rankings. SEO, which requires the placement of keywords into your content, is critical, and when effective, will make your credit union stand out from the competition.

8. Be your members’ go-to financial resource.

Marketing isn’t just advertising; it’s a way to showcase your care, knowledge, and expertise. And financial education — whether through web content, emails, or newsletters — is at the core. Consider regular email campaigns that drive members to a landing page or blog with educational pieces. Teach members about budgeting, how to shop for a home, compare credit card offers, or the benefits of refinancing. Plant the seeds now, and when your members are ready, they’ll turn to you first.